Stay compliant in 2025! Get the updated, detailed chart for GST late fees 2025 and penalties for GSTR-1, GSTR-3B, GSTR-9, and more. Learn the daily charges, maximum caps by turnover, interest rates (18% & 24%), and how to avoid costly non-compliance. Essential reading for all GST registered businesses in India.

The Core Penalty: Late Fees for Delayed Return Filing

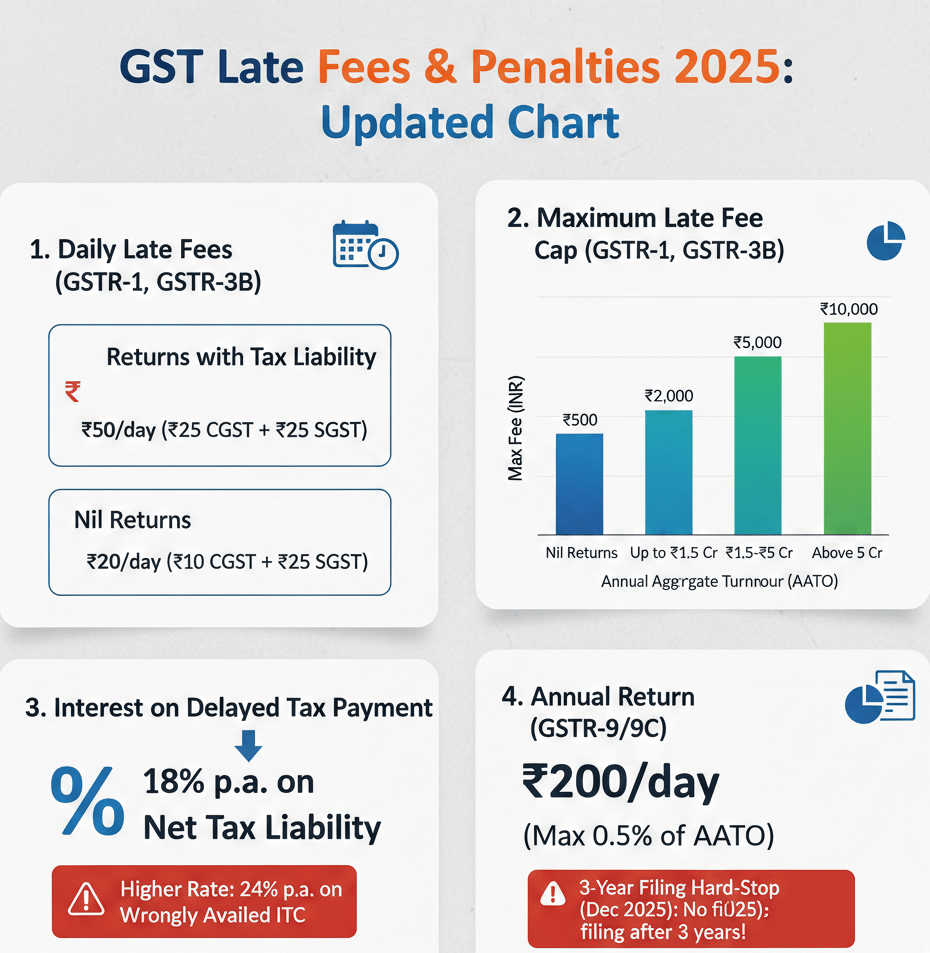

The most common compliance default is the late filing of periodic returns like GSTR-3B and GSTR-1. A late fee is charged daily from the due date until the actual date of filing. This fee is levied separately under both the Central Goods and Services Tax (CGST) Act and the State Goods and Services Tax (SGST) Act.

1. GSTR-3B and GSTR-1 Late Fees: The Daily Tally

GSTR-3B (the summary return cum tax payment form) and GSTR-1 (the statement of outward supplies or sales) are the foundational monthly or quarterly returns. The late fee structure for these two forms is currently linked to the nature of the return being filed, i.e., whether it is a Nil return or a return with tax liability.

| Particulars | Late Fee per Day (CGST) | Late Fee per Day (SGST) | Total Late Fee per Day |

| Returns with Tax Liability (Other than Nil) | ₹25 | ₹25 | ₹50 |

| Nil Returns (Zero Tax Liability) | ₹10 | ₹10 | ₹20 |

This daily late fee is critical because it continues to accumulate until the return is finally filed. The good news is that the government has rationalised these fees by imposing a maximum cap, which varies based on the taxpayer’s aggregate annual turnover (AATO).

2. Maximum Cap for GSTR-3B and GSTR-1 (AATO-based)

The maximum late fee cap ensures that the penalty does not become unduly punitive. The limit applies separately to GSTR-3B and GSTR-1 for each return period.

| Annual Aggregate Turnover (AATO) in Previous FY | Maximum Late Fee Cap (CGST) | Maximum Late Fee Cap (SGST) | Total Maximum Late Fee |

| Nil Returns (All Taxpayers) | ₹250 | ₹250 | ₹500 |

| Up to ₹1.5 Crore (Other than Nil) | ₹1,000 | ₹1,000 | ₹2,000 |

| Above ₹1.5 Crore up to ₹5 Crore (Other than Nil) | ₹2,500 | ₹2,500 | ₹5,000 |

| Above ₹5 Crore (Other than Nil) | ₹5,000 | ₹5,000 | ₹10,000 |

💡 Key Takeaway: Even a Nil return must be filed on time. Delaying a Nil GSTR-3B or GSTR-1 can still cost a business up to ₹500 for that single return period. File Nil return now on GST Portal.

The Twin Burden: Interest on Delayed Tax Payment

A late fee is a charge for not filing the return document on time, but a separate liability is triggered for not paying the GST amount due. This liability is in the form of interest, which is mandatory under Section 50 of the CGST Act. Interest is levied on the net tax liability paid through the electronic cash ledger.

1. Standard Interest Rate (18% per Annum)

If a taxpayer delays the payment of the GST liability, interest is charged at 18% per annum on the outstanding amount.

The interest starts accruing from the day immediately following the due date until the day the payment is actually made. This applies to any delay in paying tax in GSTR-3B or the monthly payment by a Quarterly Return Monthly Payment (QRMP) scheme taxpayer (via Form PMT-06).

2. Higher Interest Rate (24% per Annum)

A much higher interest rate of 24% per annum is levied in cases of financial impropriety:

- Wrongly availed and utilised Input Tax Credit (ITC): If a taxpayer claims and uses ITC that they are not legitimately entitled to, the interest on the wrongfully utilised amount is charged at 24%.

- Excessive reduction in output tax liability: Any misrepresentation that leads to a lower tax outflow is also penalised at this higher rate.

Annual Compliance: GSTR-9 and GSTR-9C Late Fees

The annual return, GSTR-9, and the Reconciliation Statement, GSTR-9C (if applicable), are the year-end finalisation documents. The deadline for filing these forms for a financial year (e.g., FY 2024-25) is typically December 31st of the subsequent financial year. A delay here attracts a high daily late fee, although it is subject to a percentage cap.

1. GSTR-9 and GSTR-9C Daily Late Fee

The daily late fee for the annual return is the highest among all major GST returns.

| Return Type | Late Fee per Day (CGST) | Late Fee per Day (SGST) | Total Late Fee per Day |

| GSTR-9 (Annual Return) | ₹100 | ₹100 | ₹200 |

2. Maximum Cap for GSTR-9 (AATO-based)

The government has rationalised the maximum penalty for the annual return filing to a very small fraction of the taxpayer’s turnover.

| Annual Aggregate Turnover (AATO) in Previous FY | Maximum Late Fee Cap (CGST) | Maximum Late Fee Cap (SGST) | Total Maximum Late Fee (CGST+SGST) |

| Up to ₹5 Crore | ₹0.02\%₹ of AATO | ₹0.02\%₹of AATO | ₹0.04\%₹of AATO |

| Above ₹5 Crore | $0.25\%$ of AATO | ₹0.25\%₹ of AATO | ₹0.50\%₹ of AATO |

Note on GSTR-9C: Following recent government clarifications, the late fee for delayed filing of GSTR-9C is not levied separately, but the delay in filing GSTR-9C extends the period for which the GSTR-9 late fee of ₹200/day is calculated, until the date the complete annual return (GSTR-9 and GSTR-9C) is furnished.

Other Key Returns and Late Fees

Compliance extends beyond the main GSTR-1 and GSTR-3B. Specific taxpayers must adhere to deadlines for other forms, each with its own late fee structure.

| Return Type | Description | Late Fee per Day (Total) | Maximum Late Fee (Total) |

| GSTR-4 (Composition Scheme) | Quarterly/Annual Return for Composition Dealers | ₹50 (Regular), ₹20 (Nil) | ₹2,000 (Regular), ₹500 (Nil) |

| GSTR-7 (TDS Return) | Tax Deducted at Source (TDS) Return | ₹200 (₹100 CGST + ₹100 SGST) | ₹5,000 |

| GSTR-8 (TCS Return) | Tax Collected at Source (TCS) by E-commerce Operators | ₹200 (₹100 CGST + ₹100 SGST) | ₹5,000 |

| GSTR-10 (Final Return) | Filed on cancellation of registration | ₹200 (₹100 CGST + ₹100 SGST) | ₹10,000 |

Penalties Beyond Late Fees: Strict Enforcement in 2025

Late fees and interest are the consequences for administrative delays. However, more severe penalties are prescribed for specific violations, particularly those involving tax evasion or fraud. The penalty structure in 2025 has become increasingly stringent, with a major emphasis on the intent behind the violation.

1. General Penalty for Non-Compliance

For minor breaches, such as failure to display the GST registration certificate or minor document errors, a general penalty is applied.

- Penalty Amount: Up to ₹25,000 (₹12,500 CGST + ₹12,500 SGST).

- Reasonable Cause Clause: Authorities have the discretion to waive penalties if the taxpayer can prove the default was due to a reasonable cause (e.g., natural calamity, technical failure).

2. Penalty for Tax Evasion and Fraud

In cases where the taxpayer wilfully misrepresents facts or suppresses transactions with the intent to evade tax, the penalties are monumental.

- 100% Penalty: If the tax short-paid or unpaid is due to fraud or willful misstatement, the penalty is 100% of the tax amount due, in addition to the tax and the interest (at 18% per annum).

- Arrest and Prosecution: Tax evasion exceeding specified thresholds (e.g., over ₹5 Crore) can lead to non-bailable offences, prosecution, and imprisonment, with terms ranging from 1 to 5 years.

3. The 3-Year Filing ‘Hard Stop’ Rule (Effective Dec 2025)

One of the most significant compliance developments in 2025 is the strict enforcement of a time limit for filing past returns.

- Rule: The GST portal is set to permanently bar businesses from filing any GST return (GSTR-1, GSTR-3B, GSTR-9) that is more than three years past its original due date.

- Impact: This rule transforms the late-filing penalty into a potential loss of registration and a permanent inability to regularise old periods. For example, returns from the 2020-21 period that were due in 2021 must be cleared before this hard stop takes effect. Businesses with old compliance backlogs must clear them immediately.

4. Suspension and Cancellation of Registration

Persistent non-filing of returns can lead to the GST registration being suspended and eventually cancelled.

- GSTR-3B: If GSTR-3B is not filed for a continuous period, typically six months, the GST Officer can initiate the cancellation process.

- Consequence: Cancellation blocks the business from carrying out taxable activities and prevents its customers from claiming Input Tax Credit, damaging the entire supply chain.

Best Practices for Iron-Clad GST Compliance in 2025

The 2025 compliance environment is marked by high levels of automation and stringent enforcement. Prevention is the only cost-effective strategy.

1. Prioritise GSTR-3B Payment: The Golden Rule

The most severe consequences—18% interest and late fees—stem from delaying GSTR-3B, as this is the form where the tax liability is paid. Always ensure the tax is paid by the 20th of the following month, even if the GSTR-1 filing is slightly delayed.

2. File Nil Returns on Time

A delay in a Nil return is often overlooked but still costs ₹20 per day, capped at ₹500 per return. Make it a mandatory monthly checklist item to file a Nil return by the due date.

3. Leverage GSTR-2B Reconciliation

GSTR-2B is the static, auto-drafted ITC statement. Mismatches between the ITC claimed in GSTR-3B and the ITC available in GSTR-2B trigger system-generated notices (Rule 88C). Ensure that your purchase ledger is reconciled with GSTR-2B before filing GSTR-3B to avoid the high 24% interest and penalties on excess claims.

4. Utilise the Amnesty Scheme

Periodically, the government releases GST Amnesty Schemes to allow taxpayers to regularise past defaults by capping the maximum late fee for older periods. Businesses with long-pending returns should actively monitor for any new Amnesty Scheme notifications in 2025 to clear their backlog at a significantly reduced cost.

5. Automation is Key

With complex deadlines and varying caps, relying on manual tracking is a recipe for non-compliance. Invest in professional accounting or tax automation software that sends timely reminders, pre-populates return forms, and flags potential ITC mismatches.

Conclusion: The Cost of Delay is Too High

The GST late fees and penalty structure for 2025 sends a clear message: the government is serious about improving taxpayer discipline. The daily late fees are designed to be a significant deterrent, while the interest on delayed tax and the severe penalties for fraud underline the high cost of non-compliance.

With a clear, updated chart and knowledge of the AATO-based caps, businesses have the tools to manage their compliance effectively. Your focus must be on creating a robust, timely, and reconciled filing process. In the GST regime, timely compliance is the single most important factor for financial health and avoiding legal scrutiny.

stay tuned for more updates on www.taxbabuji.com