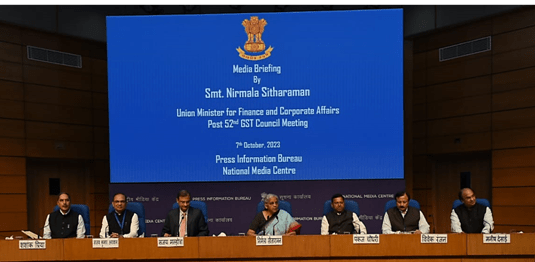

The 52nd GST Council Meeting on 07.10.2023 at New Delhi in the presence of Smt. Nirmala Sitaraman.

KEY HIGHLIGHTS OF 52ND GST COUNCIL MEETING

Changes and Understanding

- No GST in case of director do not receive any guarantee fee in case of loan disburse by banks/institutions.

- Attachment period for property and bank accounts will be automatically released after 1 year.

- Imitation and Zari Industries Now have GST rate 18 %. with out getting benefit of refund in case inverted duty structure.

- Pre packaged and labeled Millet flour in powder form (HSN 1901) than GST Rate is 5%, In all other cases rate is 0%.

- GST rate for molasses is reduced from 28% to 5%.

- List of exempted services are water supply, public health, sanitation conservancy, solid waste management and slum improvements- upgradation supplied to governments.

- 5% GST rate is applicable in case of Job work relating to processing barleys into malt.

- All the goods and services provided by Indian Railways will be taxed as per forward charge mechanism.

- Appointment of president and member at GST Appellet Tribunal.

- 18 % GST on one percent of guarantee fees provided by one company to another.