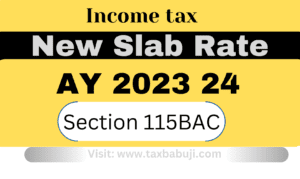

Benefits for opting new personal tax regime

(Section 115BAC)

Welcome Patrons!!!

Get your self ready for upcoming FY 2023-24.

Understand the tax slabs and Plan your finance and save money wisely.

Key Benefits to opt in new regime from 01.04.2023

Income (Rs) FY 2022-23(Rs) FY 2023-24(Rs) Tax Benefit

5 Lacs NIL NIL AT PAR

7 Lacs 33,800 NIL 33,800

9 Lacs 62,400 46,800 15,600

12 Lacs 1,19,600 93,600 26,000

7 Lacs 33,800 NIL 33,800

9 Lacs 62,400 46,800 15,600

12 Lacs 1,19,600 93,600 26,000

15 Lacs 1,95,000 1,56,000 39,000

20 Lacs 3,51,000 3,12,000 39,000

Analysis:

Government pass on more and more benefits to individual tax payer from this budget 2023-24.

As indicated above its simply tax benefit to lower class of salaried and professional having income less than seven lacs rupees will paying zero tax while earlier they paying tax about 33,800 rupees on income up to 7 lacs rupees.

Similar benefits is also given to all personal tax payer with income cape up to 15 Lacs Rupees.

Evaluate your incomes and plan your money.

Next Topic to be publish is :

Government want to discourage saving to boost up GDP of India.

( Large Scale Implication of such ideology)

Visit us for query: caviranchi.com

Post Query on : caviranchi.com