In India, the time taken for income tax refunds can vary based on several factors. Normally Income tax refund directly deposited to Bank account mentioned in ITR. You must e verify your ITR within 30days of time after filing of time otherwise your ITR becomes Invalid.

Common key points for processing of ITR and approval of Refund.

- Filing Method: If you file your income tax return electronically (e-filing), you can generally expect a faster refund compared to filing a paper return. E-filing reduces processing time and errors, expediting the refund process. Practically refund processed in 3-90 days based on the refund type.

- Accuracy of Return: Ensuring accuracy in your tax return minimizes the chances of delays in processing. Any discrepancies or errors may lead to additional scrutiny and delay in refund processing. Many tax payer quote wrong bank details so that refund is not deposited after successfully processing of ITR.

- Claiming Deductions and Credits: If you’ve claimed deductions or tax credits in your return, especially those requiring additional verification or documentation, it may take longer for the refund to be processed.

- Verification Process: The Income Tax Department may conduct random or selective audits to verify the information provided in the tax return. If your return is selected for scrutiny, it can delay the refund process.

- Communication from Tax Authorities: The Centralized Processing Center (CPC) of the Income Tax Department in Bengaluru processes most income tax returns. You can check the status of your refund online through the Income Tax Department’s website or by contacting their helpline.

- Refund Cycle: Typically, income tax refunds are processed within a few weeks to a few months after the return is filed, provided there are no issues or discrepancies. However, during peak filing seasons or due to increased workload, processing times may vary.

- Direct Deposit: If you’ve opted for direct deposit of your refund into your bank account, you’ll generally receive it faster than if you choose to receive a paper check by mail. Direct deposit ensures quicker and more secure delivery of refunds.

- Communication with Tax Authorities: If you haven’t received your refund within a reasonable timeframe of 90 days, you can contact the Income Tax Department’s helpline or visit their website to check the status of your refund. They may provide updates or assistance regarding the processing of your refund.

- Interest on Delayed Refunds: In case the Income Tax Department delays issuing the refund beyond a certain period (typically three to six months from the end of the assessment year), they may pay you interest on the refund amount

It’s important to file your income tax return accurately and promptly to expedite the refund process. Additionally, keeping track of your refund status through official channels can help ensure timely receipt of your refund.

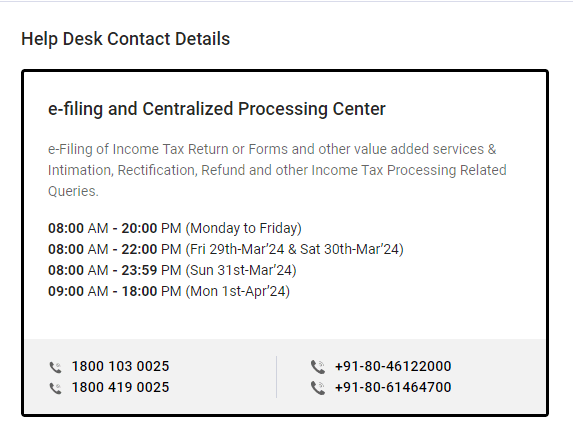

e-filing and Centralized Processing Center

e-Filing of Income Tax Return or Forms and other value added services & Intimation, Rectification, Refund and other Income Tax Processing Related Queries.

08:00 AM – 20:00 PM (Monday to Friday)

08:00 AM – 22:00 PM (Fri 29th-Mar’24 & Sat 30th-Mar’24)

08:00 AM – 23:59 PM (Sun 31st-Mar’24)

09:00 AM – 18:00 PM (Mon 1st-Apr’24)