Worried about a GST audit? This comprehensive compliance checklist for small businesses breaks down the top audit triggers and provides actionable steps for accurate invoicing, timely filing, and seamless ITC reconciliation to stay penalty-free.

A Goods and Services Tax (GST) audit can be a daunting prospect for any small business owner. It’s time-consuming, document-intensive, and often results in penalties, even for honest mistakes. The good news is that the majority of GST audits are triggered not by malintent, but by common clerical errors and data mismatches that an automated system flags as high-risk.

For Small and Medium Enterprises (SMEs) in India, the key to avoiding a departmental audit lies in proactive, systematized compliance.

This guide serves as your ultimate compliance roadmap. We’ll explore the biggest audit triggers, provide a step-by-step checklist to neutralize those risks, and recommend actionable strategies to keep your business operating smoothly and penalty-free.

Part I: Understanding the GST Audit Landscape

While the mandatory annual audit by a Chartered Accountant for businesses exceeding a certain turnover threshold has been largely removed (currently, the obligation for a CA-certified reconciliation statement, GSTR-9C, is waived for turnovers up to ₹5 crore), departmental audits under Section 65 or Special Audits under Section 66 remain very real threats.

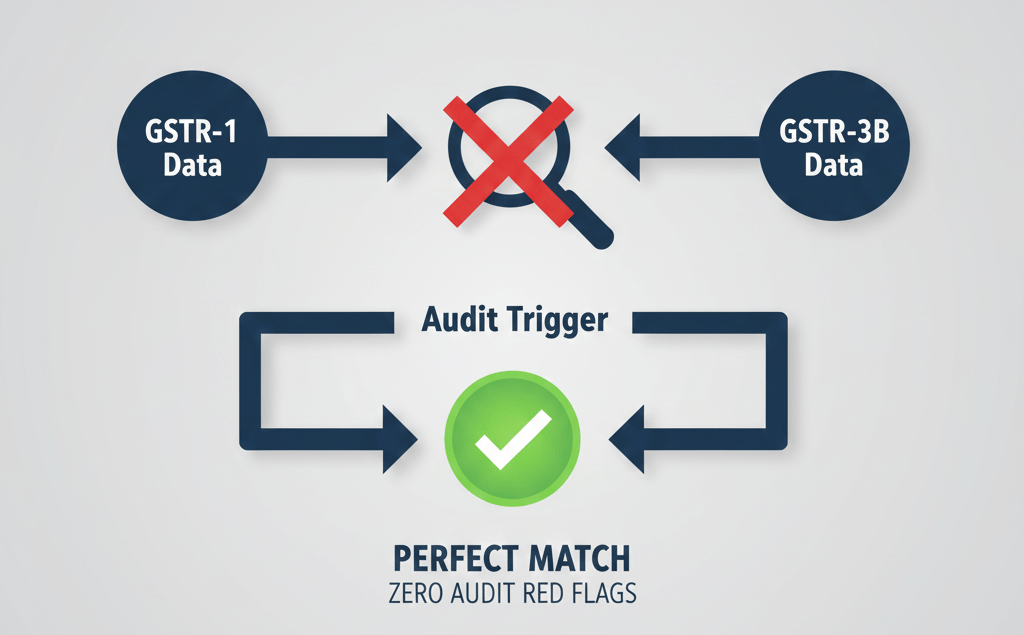

The tax authorities use sophisticated data analytics to compare your filed returns (GSTR-1, GSTR-3B) with the data of your suppliers and customers (GSTR-2B, E-Way Bills). Any significant inconsistency acts as a digital “red flag” that triggers a notice and, potentially, an audit.

The Top 5 Red Flags That Trigger an Audit

- 1. GSTR-1 vs. GSTR-3B Mismatch (Output Tax): This is the most common trigger. If the total sales (outward supplies) declared in your detailed GSTR-1 do not match the consolidated sales declared in your summary return, GSTR-3B, the system suspects under-reporting of sales.

- 2. Input Tax Credit (ITC) Mismatch (GSTR-3B vs. GSTR-2B): Claiming substantially more Input Tax Credit in your GSTR-3B than what is automatically reflected in your GSTR-2B (the record of taxes paid by your suppliers) signals potential ineligible or fraudulent claims.

- 3. Sudden or Unusual Fluctuations: An abrupt, unjustified spike or drop in turnover, ITC claims, or tax paid compared to previous periods will raise an automated red flag for closer inspection.

- 4. Frequent Amendments and Late Filings: Consistent late filing or numerous amendments to previously filed returns indicate poor compliance discipline, making your business a high-risk candidate for scrutiny.

- 5. High or Frequent Refund Claims: While legitimate, frequent or large refund claims (especially for exporters or inverted duty structure businesses) often invite a detailed audit to verify the underlying transactions and documentation.

Part II: The Zero-Audit Compliance Checklist

Avoiding an audit is less about luck and more about embedding a robust, error-proof compliance system into your daily operations.

1. The Foundation: Registration & Documentation Accuracy

| Checkpoint | Action to Take | Audit Risk Neutralized |

| GSTIN Details Verification | Ensure your GST Registration Certificate details (legal name, address, directors/partners) are 100% accurate and updated on the GST portal. | Discrepancies leading to communication failure or misidentification. |

| Place of Business | Display your GSTIN conspicuously at your principal and all additional places of business as listed in the certificate. | Compliance with basic registration rules. |

| Record Retention | Maintain all books of accounts, invoices, credit/debit notes, and returns for a minimum of six years from the due date of filing the Annual Return for the financial year. | Inability to furnish documents during an audit. |

| Tax Rate/HSN Mapping | Cross-check the HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) codes and corresponding GST rates for all your goods and services. A wrong code can lead to short-payment of tax. | Wrong tax calculation and under-reporting. |

2. Master Your Invoicing and Outward Supply

Your tax invoice is the primary document an auditor will check. It must be perfect.

- Mandatory Invoice Elements: Verify every single invoice contains all mandatory information:

- Your name, address, and GSTIN.

- Buyer’s name, address, and GSTIN (if registered).

- Invoice number (unique and sequential) and date.

- HSN/SAC code and description of goods/services.

- Taxable value and tax breakdown (CGST, SGST, IGST, Cess).

- Place of Supply (especially critical for inter-state sales).

- Digital or physical signature.

- Time of Supply Compliance: Issue the tax invoice within the prescribed time limits (e.g., typically before or at the time of removal for goods, and within 30 days for services).

- Credit/Debit Notes: Ensure all Credit Notes (for sales returns or post-sale discounts) are issued and reported in GSTR-1 before the due date for the September return of the following financial year or the date of filing the relevant Annual Return, whichever is earlier.

- E-Invoicing and E-Way Bills: If mandatory for your turnover limit, ensure e-invoices are generated for all B2B supplies and uploaded to the Invoice Registration Portal (IRP) within the stipulated 30-day limit. E-Way Bills must be generated accurately for goods movement above the value threshold, with details matching the corresponding invoice.

3. The Reconciliation Engine: Your Ultimate Audit Shield

This is the most critical section. Discrepancies in reconciliation are the top reason for audit notices.

| Reconciliation Type | Frequency | Why It Matters |

| GSTR-1 vs. GSTR-3B (Output Tax) | Monthly | Ensures all declared sales in GSTR-1 have tax duly paid in GSTR-3B. Action: Perform this reconciliation before filing GSTR-3B. Any difference must be justified and documented. |

| GSTR-3B vs. GSTR-2B (ITC) | Monthly | Guarantees that you only claim ITC that your suppliers have actually reported and paid. Action: Only claim the ITC reflected in GSTR-2B. For any missing invoices, follow up with your supplier to ensure they upload them. |

| Books vs. Returns | Quarterly/Annually | Match your total sales, purchases, and tax payments in your internal financial software (Tally, Zoho, etc.) with the aggregate figures reported in GSTR-1 and GSTR-3B. |

Pro-Tip: The 2B Rule: Make it a company policy to claim ITC strictly based on GSTR-2B. Do not wait for the year-end. Conduct a monthly ITC reconciliation, communicate with non-compliant vendors, and delay payment or reduce future purchase orders with vendors who consistently fail to file.

4. Tax Payments and Reverse Charge Mechanism (RCM)

- Timely Tax Deposit: Pay the GST liability as declared in GSTR-3B by the due date. Delays accrue interest at 18% per annum and are a major audit trigger.

- Reverse Charge Compliance: Accurately identify services and goods where you are liable to pay tax under RCM (e.g., legal services, import of services).

- Action: Ensure RCM liability is paid via the electronic cash ledger (reported in GSTR-3B) and that the corresponding eligible ITC is claimed only after the payment is made.

5. The Annual Compliance Cleanup

Even if your turnover is below the mandatory audit limit, the Annual Return (GSTR-9) and Reconciliation Statement (GSTR-9C) are crucial compliance documents.

- File GSTR-9 (Annual Return): Even if optional for small businesses with turnover below ₹2 crore, filing it helps formalize your entire year’s data and provides a comprehensive self-assessment.

- Pre-Filing Self-Audit: Before filing the Annual Return, conduct a final review:

- Did your total sales in GSTR-1 match GSTR-3B for the year?

- Did your ITC claims in GSTR-3B match the annual GSTR-2B data?

- Have all Credit/Debit Notes for the previous year been accounted for?

Part III: Proactive Strategies and Automation

The modern GST regime is designed for speed and accuracy. Manual errors are the enemy.

1. Implement a Clear Compliance Calendar

Create an internal calendar that sets deadlines before the official GST due dates. Assign specific team members (or your consultant) ownership for each task:

| Task | Internal Deadline | Owner |

| Monthly ITC Reconciliation (GSTR-2B) | 5th of the following month | Accounts Executive |

| File GSTR-1 | 10th of the following month | Accounts Executive |

| File GSTR-3B & Pay Tax | 18th of the following month | CFO/Consultant |

| Annual Return (GSTR-9) Prep | End of October | Consultant |

2. Leverage Technology and Automation

GST software (e.g., Tally, Zoho Books, or specialized compliance tools) are no longer a luxury; they are a necessity for audit avoidance.

- Automated Reconciliation: Use software that auto-downloads GSTR-2B/2A data and matches it line-by-line with your purchase register, instantly flagging mismatches.

- Invoice Accuracy: Use software that validates GSTINs and HSN codes automatically before the invoice is generated, eliminating clerical errors.

- E-Way Bill Integration: Use tools that integrate e-way bill generation with your sales data to ensure consistency across all records.

3. Conduct a Quarterly Internal Audit

Don’t wait for the tax department. Every quarter, have your internal team or an external accountant conduct a mini-audit:

- Check List:

- Verify the proper classification of all new services/goods introduced.

- Review bank statements against RCM payments to ensure no liability was missed.

- Check for any instances of ineligible ITC claims (e.g., ITC on blocked credit items like personal consumption, car purchases, or business entertaining).

- Review documents for any unusual or related-party transactions and ensure proper valuation.

Conclusion: Your Audit-Proof Business

For small businesses, avoiding a GST audit boils down to three core principles: Consistency, Accuracy, and Reconciliation.

By implementing a rigorous monthly reconciliation process, leveraging technology to minimize human error, and proactively addressing any internal discrepancies before the filing deadlines, you effectively remove all the major red flags that data analytics use to select cases for audit. You transform your business from a high-risk target into an exemplary compliant taxpayer.

A clean compliance record not only saves you from audits, penalties, and interest costs but also enhances your business’s credibility in the eyes of bankers, lenders, and key vendors.

For more such blog stay tuned to www.taxbabuji.com