Introduction : News Updates on GST Bank Validation

As we all aware of the fact that GST department announce updates on frequent basis. GST law is not complex if all the amendments and updates are understand by you on real time basis. In this blog we are going to discuss latest GST advisory on changes in core field data otherwise your GST registration will be impacted /cancelled if not take necessary pre caution by you. This GST news update on bank validation advisory is for your quick and easy reference.

Bank Account Validation

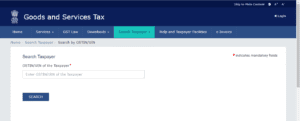

How to check GST bank account Validation Status ?

Step 1: Login to your GSTIN (You must have valid registration id and password)

Step 2: Click On the My Profile Tab (Top Right side —> Click on it )

Step 3: Go to Quick Link and Click on Bank Account Status (Select from left end side bar)

Kindly take a note that if your account shown Validated that means you do not have to worry otherwise you must validate your bank account in GST. It may possible that your bank account shown under process or validation error status. Than you must update your KYC documents along with your GSTIN to the respective bank in which your current account is belongs. After successful updating of your data to bank kindly recheck the status following the same process as per above step. Its so simple and easy. Alternative one can also change the current account details in GST if after many efforts bank account status not updated.

Official Advisory

GST department issued a advisory on mandatory validation of bank account. On official GST Website advisory dated 24/04/2023 is published and matter is about, How you can check your bank validation status ? and if it will require to update/delete or add new account to your GST profile account.

GST taxpayer who missed their validation may face discontinuation ( Cancelled) of their GSTIN in future. As bank account details is mandatory to successfully register on GSTIN and if any mismatch or wrong details and records found is liable to cancellation of your registration.

Official Advisory Document : Click here to read

Extract Advisory on Bank Account Validation :

Dear Valued Tax Payers,

1. GSTN is pleased to inform you that the functionality for bank account validation is now integrated with the GST System. This feature is introduced to ensure that the bank accounts provided by the Tax Payer is correct.

2. The bank account validation status can be seen under the Dashboard→ My Profile → Bank Account Status tab in the FO portal.

Tax Payers will also receive the bank account status detail on registered email and mobile number immediately after the validation is performed for his declared bank account.

3. Post validation, any bank account number in the database would have one status out of the below mentioned four status types. The exact details of the accounts can be seen by hovering mouse over these icons in the Tax Payers’ dashboard in FO Portal.

4. Whenever, the Tax Payer is shown ‘Failure’ icon with further details such as

– The entered PAN number is invalid.

– PAN not available in the concerned bank account.

– PAN Registered under GSTIN, and the PAN maintained in the Bank Account are not same.

– IFSC code entered for the bank account details is invalid.

In these cases, the Tax Payer is expected to ensure that he has entered correct bank details and the KYC is completed by bank for his bank account.

5. Whenever, the Tax Payer is shown, the status of his bank account as ‘Success With Remark’ icon with details “The account cannot be validated since the bank is not integrated with NPCI for online bank account validation”, the Tax Payer should provide alternate bank account number so that it can be revalidated to expedite further online

processes.

6. If the account status is shown as “Pending for Validation” then please wait since the account will be validated by NPCI.

7. The Tax Payer at any time can add/delete the bank account details and new account details will be validated.

By Team GSTN

Understand this via Video:

You can also visit YouTube video to understand more about this updates. (Live Demo)