Master GSTR-9 Annual Return FY 2024-25. Covers turnover limits, legal sections, new Table 6A1 updates, reconciliation tips, and late fees.

Legal Framework & Applicability

The requirement to file an Annual Return is rooted in the Central Goods and Services Tax (CGST) Act, 2017.

Key Legal Sections

- Section 44: Mandates every registered person (with specific exceptions) to furnish an annual return.

- Rule 80: Prescribes the forms (GSTR-9, 9A, 9B) and the manner of filing.

- Section 47(2): Governs the levy of late fees for delayed filing of the annual return.

- Section 35(5): (Historical reference) Previously mandated GST Audit, now replaced by self-certified reconciliation in GSTR-9C under Section 44.

Who Must File for FY 2024-25?

| Turnover Limit | Requirement |

| Up to ₹2 Crore | Exempted (Notification No. 15/2025-CT). Filing is optional but recommended if data needs correction. |

| Above ₹2 Crore up to ₹5 Crore | Mandatory to file GSTR-9. GSTR-9C is not required. |

| Above ₹5 Crore | Mandatory to file both GSTR-9 and GSTR-9C (Self-certified reconciliation). |

Exempted Categories: Input Service Distributors (ISD), Casual Taxable Persons, Non-Resident Taxable Persons, Persons deducting TDS (u/s 51) or collecting TCS (u/s 52).

Important Dates and Late Fees

- Due Date: 31st December 2025 (for FY 2024-25).

- Late Fees (Section 47):

- Turnover up to ₹5 Cr: ₹50 per day (₹25 CGST + ₹25 SGST), capped at 0.04% of turnover.

- Turnover ₹5 Cr to ₹20 Cr: ₹100 per day (₹50 CGST + ₹50 SGST), capped at 0.04% of turnover.

- Turnover above ₹20 Cr: ₹200 per day (₹100 CGST + ₹100 SGST), capped at 0.50% of turnover.

Major Changes for FY 2024-25

This year introduces structural shifts to increase transparency and reduce litigation.

Introduction of Table 6A1

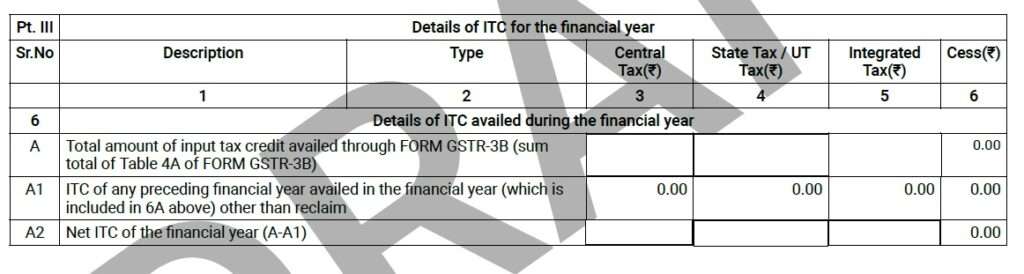

This is the most significant change. Table 6A1 is designed to report ITC pertaining to the previous year (FY 2023-24) that was claimed in the current year (FY 2024-25).

- Purpose: To prevent the “doubling” of ITC in the system and provide legal clarity on cross-year claims under Section 16(4).

Integration of GSTR-1A

Any amendments or additional supplies reported through the newly introduced GSTR-1A (Amended Outward Supplies) will now be auto-populated in Tables 4 and 5 of GSTR-9.

Table 8A – GSTR-2B Integration

Table 8A (ITC as per GSTR-2B) will now include invoices of FY 2024-25 reported by suppliers up to 30th November 2025. This aligns with the time limit for claiming ITC.

Table-wise Breakdown of GSTR-9

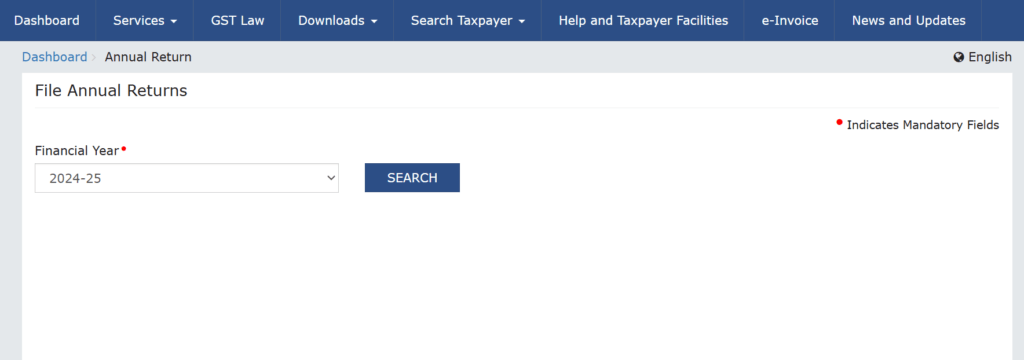

Select the year and than press search to go ahead.

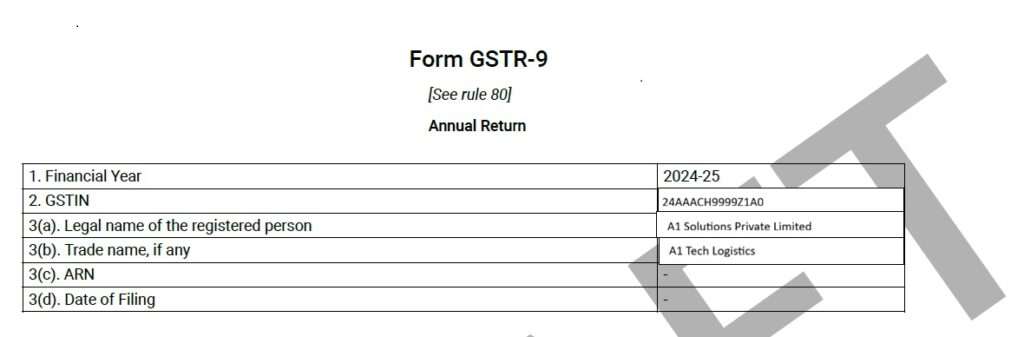

The form is divided into 6 Parts and 19 Tables.

Basic Details

- Tables 1-3: Auto-filled details like GSTIN, Legal Name, and Trade Name.

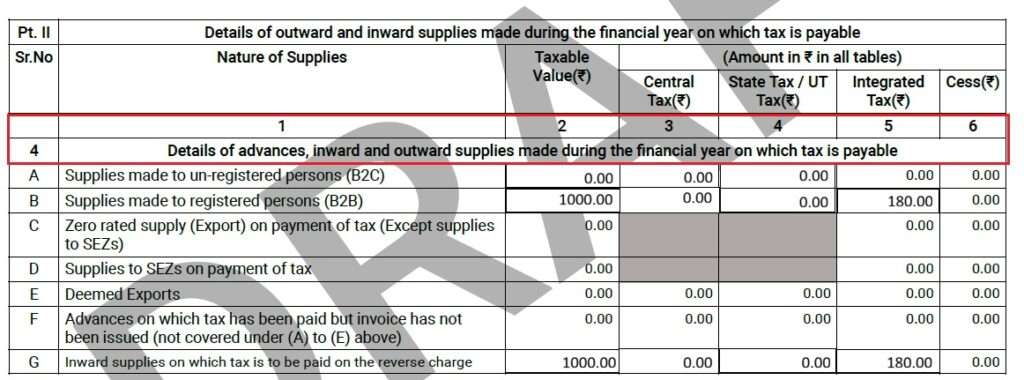

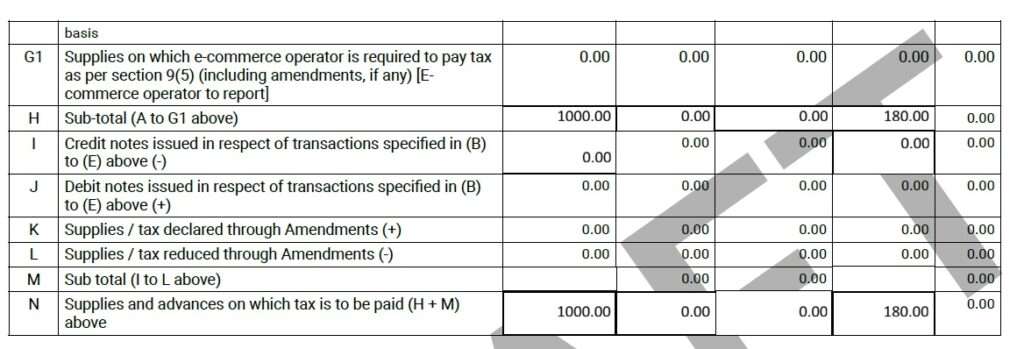

Details of Outward & Inward Supplies (Tax Liability)

- Table 4: Taxable outward supplies (B2B, B2C, Exports with payment, SEZ with payment).

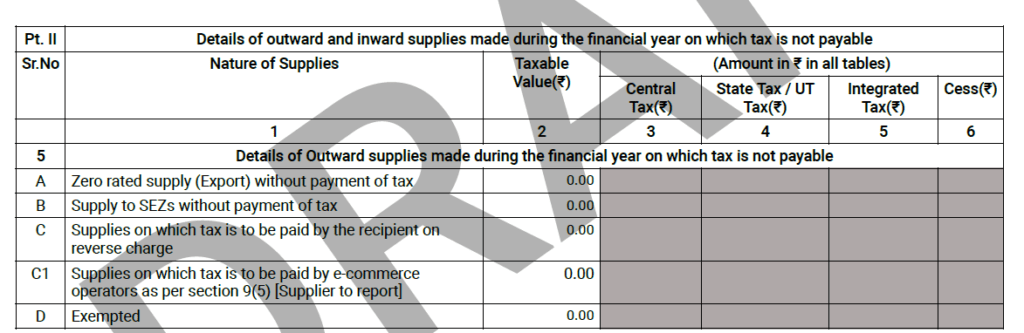

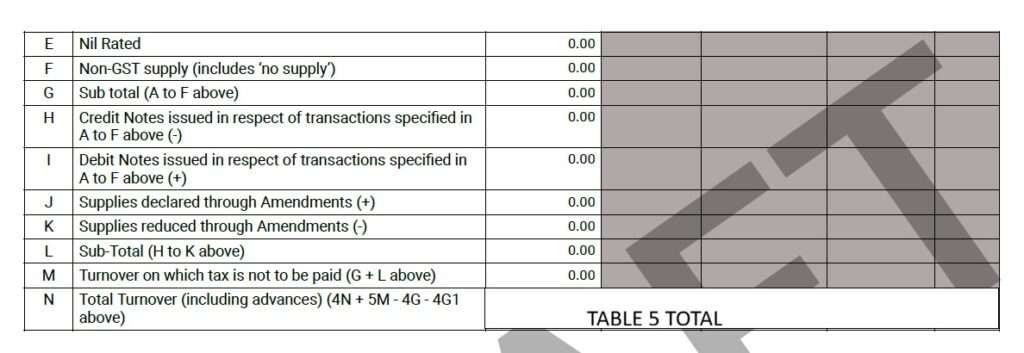

- Table 5: Exempt, Nil-Rated, and Non-GST outward supplies.

- Key Tip: Ensure B2B supplies match your GSTR-1 and GSTR-3B exactly.

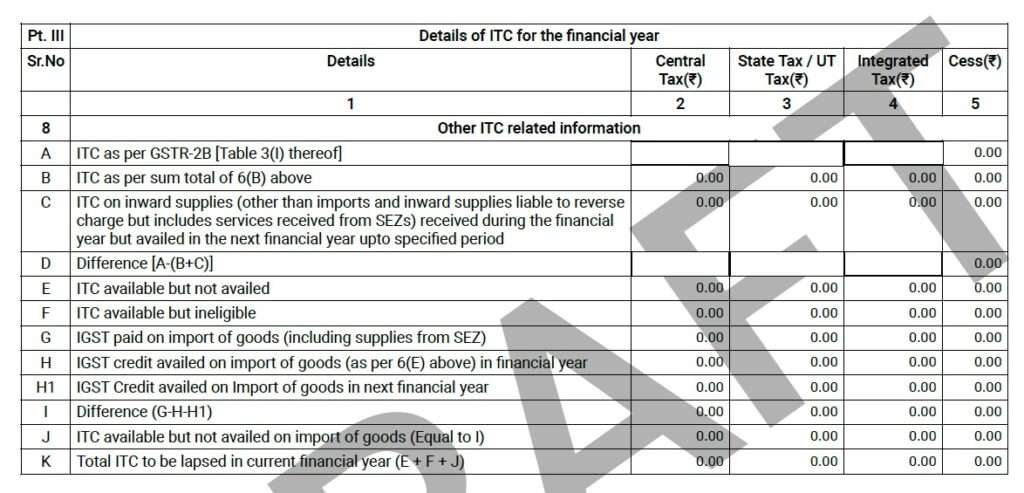

Input Tax Credit (ITC)

- Table 6: ITC availed during the year.

- Table 6A1: Report prior year ITC claimed this year.

- Table 6B: ITC on inward supplies (excluding RCM).

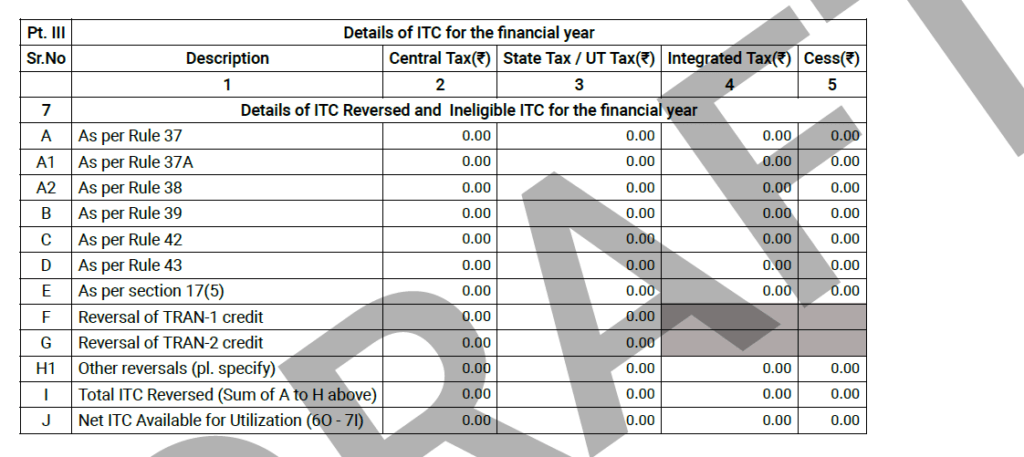

- Table 7: ITC reversals (Rule 37, 38, 42, 43, and Section 17(5)).

- Table 8: ITC Reconciliation (2B vs. 3B). This is the most scrutinized section.

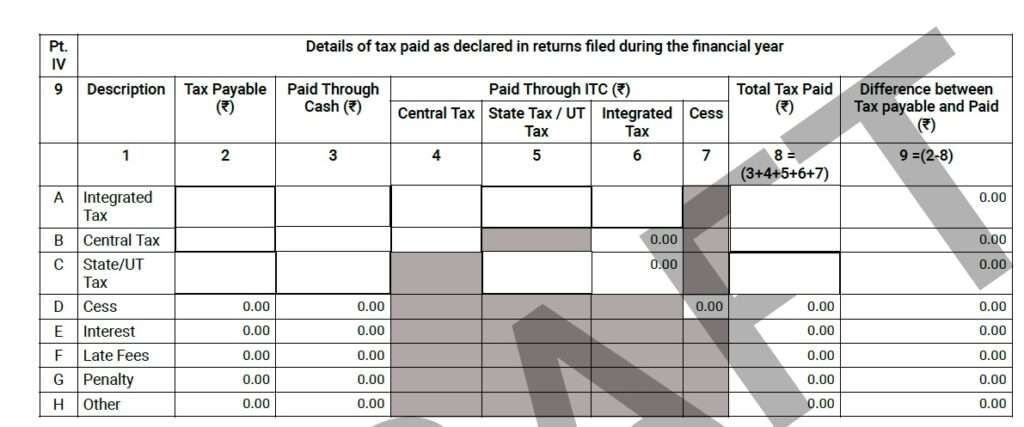

Tax Paid

- Table 9: Details of tax paid as declared in returns. You can only pay additional liability via DRC-03; you cannot claim a refund through GSTR-9.

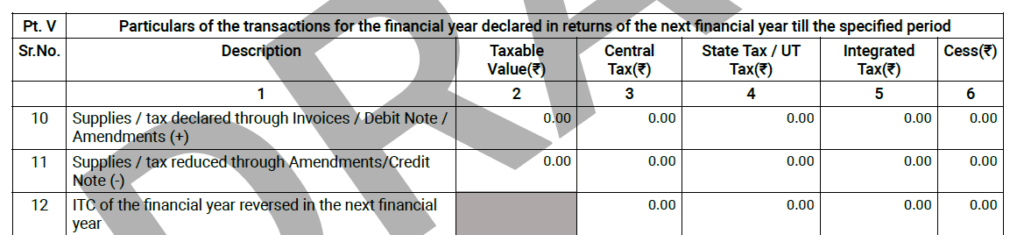

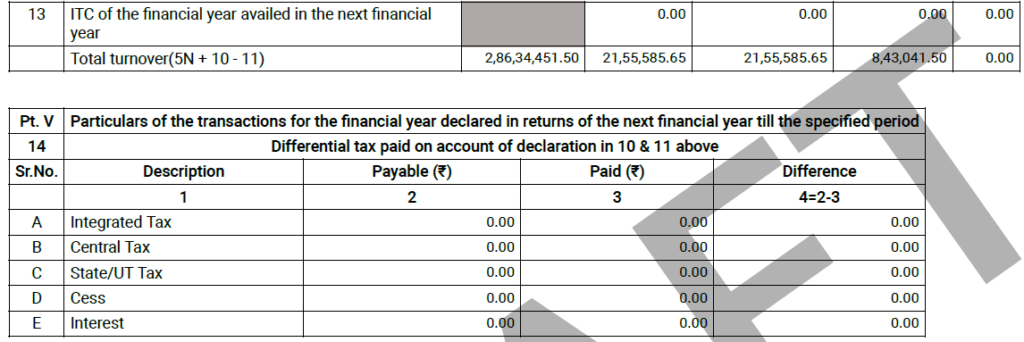

Transactions of FY 2024-25 reported in next FY

- Tables 10-14: If you made corrections for FY 24-25 in the returns filed between April 2025 and November 2025, report them here.

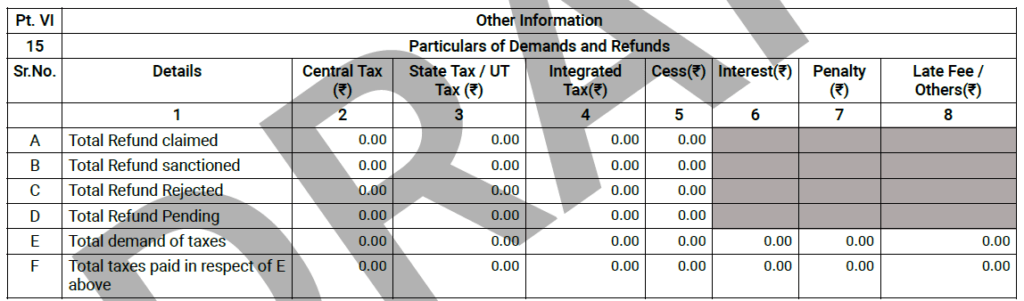

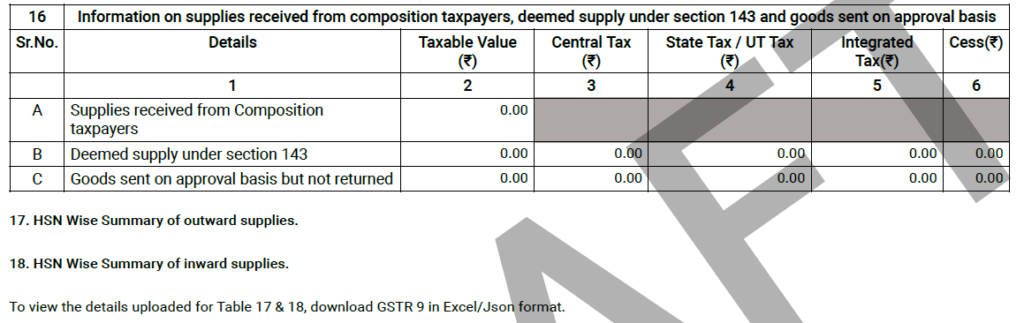

Other Information

- Table 15-16: Demands, refunds, and supplies from composition dealers.

- Table 17-18: HSN Summary for Outward and Inward supplies.

- Note: HSN summary for inward supplies is optional if turnover is below ₹5 crore.

Step-by-Step Filing Process

- Reconciliation (The Core Task):

- Match Books of Accounts vs. GSTR-1 vs. GSTR-3B.

- Reconcile GSTR-3B (ITC claimed) vs. GSTR-2B (ITC available).

- Download System-Generated Summaries:

- Download the GSTR-9 PDF and Excel summary from the GST Portal.

- Fill the Tables:

- Check auto-populated data. Correct any errors (variations up to 20% are generally allowed without red flags, but accuracy is paramount).

- Discharge Additional Liability:

- If you find unpaid taxes, use Form GST DRC-03 to pay via the Electronic Cash Ledger.

- Submit and File:

- Preview the draft, authenticate via DSC or EVC, and file.

Crucial Checklist for Taxpayers

- Rule 37 Compliance: Ensure all vendors are paid within 180 days; otherwise, reverse ITC in Table 7.

- Rule 37A Compliance: Ensure vendors have filed GSTR-3B; otherwise, ITC must be reversed.

- HSN Reporting: Ensure 6-digit HSN codes for taxpayers with turnover > ₹5 Cr.

- No Revision: Remember, GSTR-9 cannot be revised once filed. Triple-check every entry.

Conclusion

Filing the GSTR-9 for FY 2024-25 is not just about copying data from monthly returns; it is an audit of your entire year’s compliance. With the portal now tracking cross-year ITC through Table 6A1, the “wait and see” approach no longer works.

Stay tuned on www.taxbabuji.com