Goods-in-Transit Vehicle met an Accident What to do?, Understand the Income Tax (IT) and GST implications on loss of stock, vehicle WDV, insurance claims, and mandated ITC reversal under Section 17(5)(h).

An accident involving a goods vehicle in transit is a significant business disruption. Beyond the immediate operational headache, it triggers crucial questions regarding the treatment of the resulting losses and insurance claims under India’s tax laws.

Here is key considerations under the Income Tax Act, 1961 (IT Act), and the Central Goods and Services Tax Act, 2017 (CGST Act).

The Income Tax Act, 1961 Perspective

The primary concern under the IT Act is whether the loss can be claimed as an expense and how the insurance claim, if any, is treated.

| Aspect | Income Tax Treatment | Key Section |

| Loss of Goods (Stock-in-Trade) | The loss of stock-in-trade (the goods being transported) due to an accident is generally treated as a normal business loss. It is debited to the Profit & Loss Account and is fully deductible from the business income, thereby reducing the taxable profit. | Section 37(1) |

| Loss of Vehicle (Capital Asset) | If the vehicle is completely destroyed (Total Loss): The loss is absorbed in the Written Down Value (WDV) of the asset. The WDV as on the date of accident will be part of the block of assets. Since the asset is destroyed, the money received from the insurer (Salvage value + Insurance claim) will reduce the WDV of the block. If the WDV of the block becomes negative, it is treated as a Short-Term Capital Gain. | Section 32 & 50 |

| Insurance Claim Received | 1. For Loss of Goods: The claim received is treated as a business receipt and is credited to the Profit & Loss Account. It will be set off against the loss claimed, and only the net loss (or gain) will affect your taxable income. 2. For Loss of Vehicle (Capital Asset): The insurance compensation for a destroyed asset is treated as the “Sale Consideration.” Any amount exceeding the WDV of the block of assets (after adjusting for the compensation received) is treated as a Short-Term Capital Gain and taxed accordingly. | Section 28 & 50 |

| Repair & Maintenance | Costs incurred for the repair of the vehicle (if not a total loss) and other associated expenses like towing are generally deductible as business expenditure. | Section 37(1) |

Important Note: Proper documentation, including FIR, insurance survey reports, and accounting entries, is crucial to substantiate the loss claim during an income tax assessment.

The CGST Act, 2017 Perspective

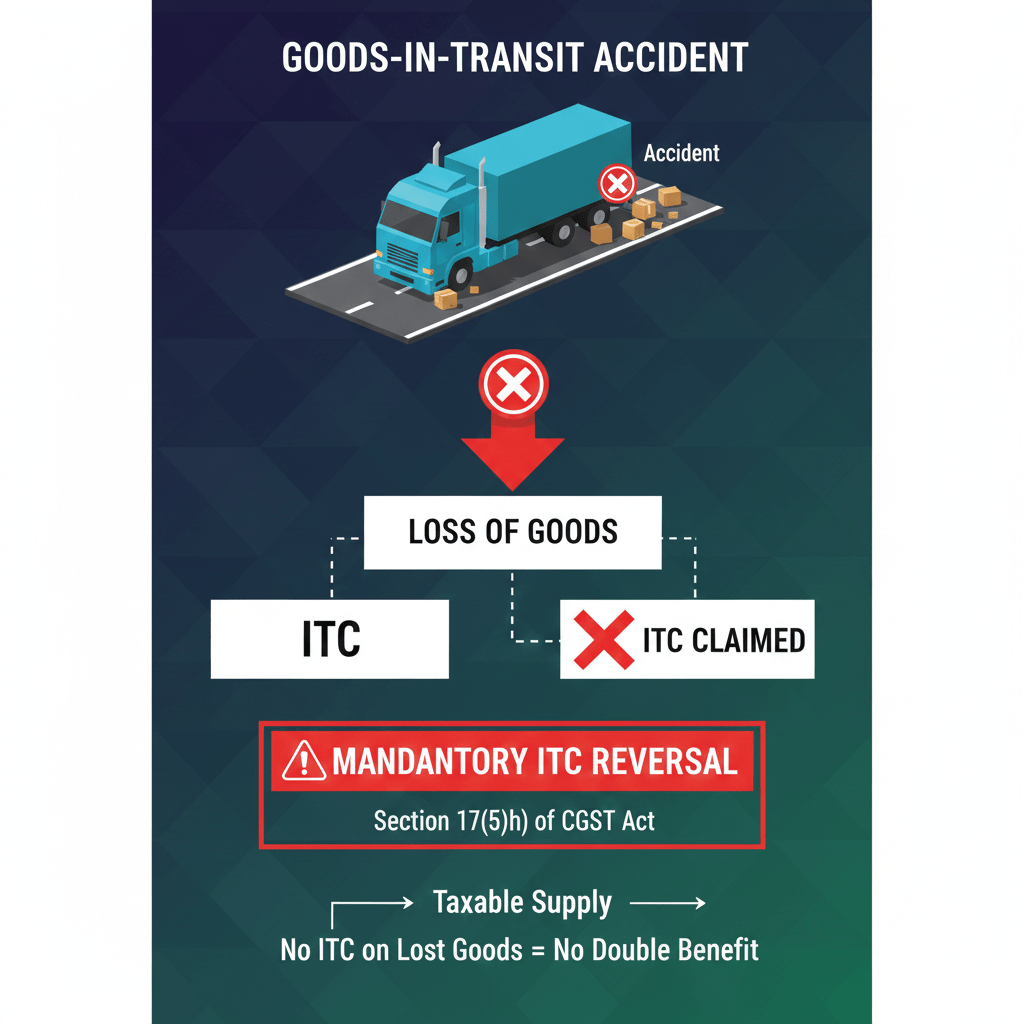

The CGST Act’s main impact on an accident loss is the potential requirement to reverse the Input Tax Credit (ITC) claimed on the lost goods.

| Aspect | CGST Treatment | Key Section |

| Loss of Goods Lost/Destroyed | The core principle is established by Section 17(5)(h): Input Tax Credit (ITC) is not available in respect of goods lost, stolen, destroyed, written off, or disposed of by way of gift or free samples. Therefore, if the goods are lost or destroyed in the accident and you had previously claimed ITC on the purchase of those goods (or the inputs used to manufacture them), you are required to reverse the corresponding ITC. | Section 17(5)(h) |

| Loss of Capital Goods (Vehicle) | If the vehicle is completely written off and removed from the business, ITC reversal may also be required on the remaining useful life of the vehicle (calculated on a pro-rata basis for a presumed useful life of 5 years). | Rule 44 of CGST Rules |

| Insurance Claim Received | The insurance claim received is generally for the loss/damage suffered and is not considered a “supply” under GST. Therefore, GST is not levied on the claim amount itself. | – |

| GST on Repairs | GST paid on the repair services for the vehicle is generally eligible for ITC, provided the vehicle is used for a taxable business and is not one of the blocked credits (e.g., motor vehicles for passenger transport with seating capacity less than 13, unless specifically used for business of transport). | Section 16 & 17(5) |

Reversal Requirement: The reversal must be calculated and reported in Table 4(B)(2) of GSTR-3B in the month the loss is determined and written off. This ensures the business does not benefit from ITC on goods that never contributed to a taxable outward supply.

Summary: Action Points for Your Books

| Transaction | Income Tax (IT Act) | GST (CGST Act) |

| Cost of Lost Goods | Debit to P&L as a deductible Business Loss. | Reverse ITC on the lost goods (or inputs thereof) under Section 17(5)(h). |

| Insurance Claim Received (Goods) | Credit to P&L as a Business Receipt (taxable). | Not considered a supply; No GST on the claim amount. |

| Repair Costs (Vehicle) | Debit to P&L as a deductible Expense. | Claim ITC on the GST component of the repair bill (subject to Section 17(5) blocking). |

| Total Loss of Vehicle | Adjust against the WDV block; may result in a Short-Term Capital Gain. | Reverse pro-rata ITC on the vehicle for the remaining useful life (Rule 44). |

Calculation for ITC Reversal on Lost Goods

The requirement to reverse ITC stems from Section 17(5)(h) of the CGST Act, which blocks ITC on goods lost, stolen, destroyed, written off, or disposed of by way of gift or free samples.

The fundamental principle is to reverse the exact amount of ITC that was originally claimed on the purchase of the goods that were subsequently destroyed in the accident.

1. The Goods Lost (Stock-in-Trade)

This calculation is straightforward if the specific goods lost can be clearly identified with their original purchase invoices.

Example: A truck carrying 100 boxes of finished goods meets an accident, and 20 boxes are completely destroyed and written off.

Action Required: The taxpayer must reverse the ITC of ₹3,600 (₹3,600 IGST, or ₹1,800 CGST + ₹1,800 SGST) claimed on the 20 destroyed boxes.

2. The Capital Goods Lost (The Vehicle)

If the vehicle (truck/trailer) itself is completely destroyed and the loss is written off, the ITC reversal is more complex, as it is based on the remaining useful life of the asset as per Rule 44 of the CGST Rules.

- The useful life of a capital asset under GST is presumed to be five years (60 months).

- For every quarter (or part thereof) the asset was held, the ITC is considered utilized.

- The ITC on the remaining life must be reversed.

Example: A truck was purchased 30 months ago for ₹30,00,000, and the ITC claimed was ₹4,00,000. The truck is now a total loss.

Action Required: The taxpayer must reverse the ITC of ₹2,00,000 for the remaining 30 months of the vehicle’s useful life.

3. Reporting the Reversal

The ITC reversal must be reflected in your GST returns:

- The amount must be reported in Table 4(B)(2) of the GSTR-3B return in the month the goods/vehicle are written off in the books of accounts, or the loss is otherwise determined.

Stay tune for more updates on : www.taxbabuji.com