Understand the common reasons for GSTR-1 vs GSTR-3B mismatches and learn how to rectify them with this step-by-step guide, incorporating the latest rules for 2025. Avoid penalties and ensure GST compliance.

Are you a business owner or GST professional struggling with discrepancies between your GSTR-1 and GSTR-3B filings? You’re not alone. These mismatches are a common challenge, but understanding their causes and the correct rectification procedures is crucial for maintaining GST compliance and avoiding penalties. With the latest rules for 2025, it’s more important than ever to be precise.

This comprehensive guide will walk you through the concept of GSTR-1 and GSTR-3B, explain the common reasons for mismatches, and provide a step-by-step approach to fixing them, all while keeping the latest regulations in mind.

Understanding GSTR-1 and GSTR-3B

Before diving into mismatches, let’s quickly recap what each return entails:

- GSTR-1: Statement of Outward Supplies GSTR-1 is a monthly or quarterly statement that details all your outward supplies (sales) made to other registered taxpayers, unregistered persons, and consumers. It captures details like invoice-wise data, debit/credit notes, and export details. This return essentially provides the tax department with information about your sales transactions.

- GSTR-3B: Monthly Summary Return GSTR-3B is a monthly summary return where you declare your consolidated outward supplies, inward supplies (purchases), input tax credit (ITC) claimed, and pay your GST liabilities. It’s a self-declaration form that provides a summary of your tax payable and ITC available for a given period.

The fundamental difference is that GSTR-1 provides granular, invoice-level details of your sales, while GSTR-3B presents a consolidated summary of your overall tax liability and ITC. Ideally, the taxable value of outward supplies declared in GSTR-1 should align with the taxable value of outward supplies declared in GSTR-3B.

Why Do Mismatches Occur? Common Reasons

Discrepancies between GSTR-1 and GSTR-3B can arise due to various reasons, often stemming from human error, system glitches, or timing differences. Here are some of the most common culprits:

- Errors in Data Entry:

- Incorrectly entering taxable values, tax amounts, or HSN codes in either return.

- Typographical errors when recording sales invoices or purchase details.

- Reporting Period Differences:

- Recording an invoice in one month’s GSTR-1 but including it in a different month’s GSTR-3B.

- Sales returns or credit notes issued in a subsequent period but relating to sales reported earlier.

- Inclusion/Exclusion of Specific Transactions:

- Forgetting to include certain types of outward supplies (e.g., deemed exports, supplies to SEZ) in GSTR-1 or GSTR-3B.

- Mistakenly including B2C sales in GSTR-1 as B2B, or vice-versa, impacting the summary.

- Debit/Credit Note Discrepancies:

- Not reporting debit or credit notes in GSTR-1, or reporting them incorrectly in GSTR-3B.

- Mismatch in the values or dates of debit/credit notes.

- Reverse Charge Mechanism (RCM):

- Incorrectly reporting RCM liability in GSTR-3B or omitting it altogether. While GSTR-1 doesn’t have a direct RCM reporting section for outward supplies, the overall tax liability calculation in GSTR-3B is affected.

- Exempted/Non-GST Supplies:

- Misclassification of exempted or non-GST supplies, leading to differences in the total taxable value.

- Software or System Glitches:

- Technical errors in accounting software or the GST portal itself can sometimes lead to data discrepancies.

Consequences of Mismatches

Ignoring GSTR-1 and GSTR-3B mismatches can lead to serious consequences:

- Notices from GST Authorities: The GST system automatically flags significant mismatches, prompting the issuance of notices (e.g., DRC-01C).

- Reversal of Input Tax Credit (ITC): If your GSTR-1 shows lower outward supplies than GSTR-3B, it might indicate over-declaration of ITC by your recipients, potentially leading to questions about their ITC claims. Conversely, if GSTR-3B shows lower tax payment, you might face scrutiny.

- Interest and Penalties: Failure to pay the correct tax liability or rectify errors within the stipulated time can result in interest charges and penalties.

- Suspension of GST Registration: Persistent non-compliance and unaddressed mismatches could even lead to the suspension or cancellation of your GST registration.

Step-by-Step Guide to Fixing Mismatches (Latest Rules 2025)

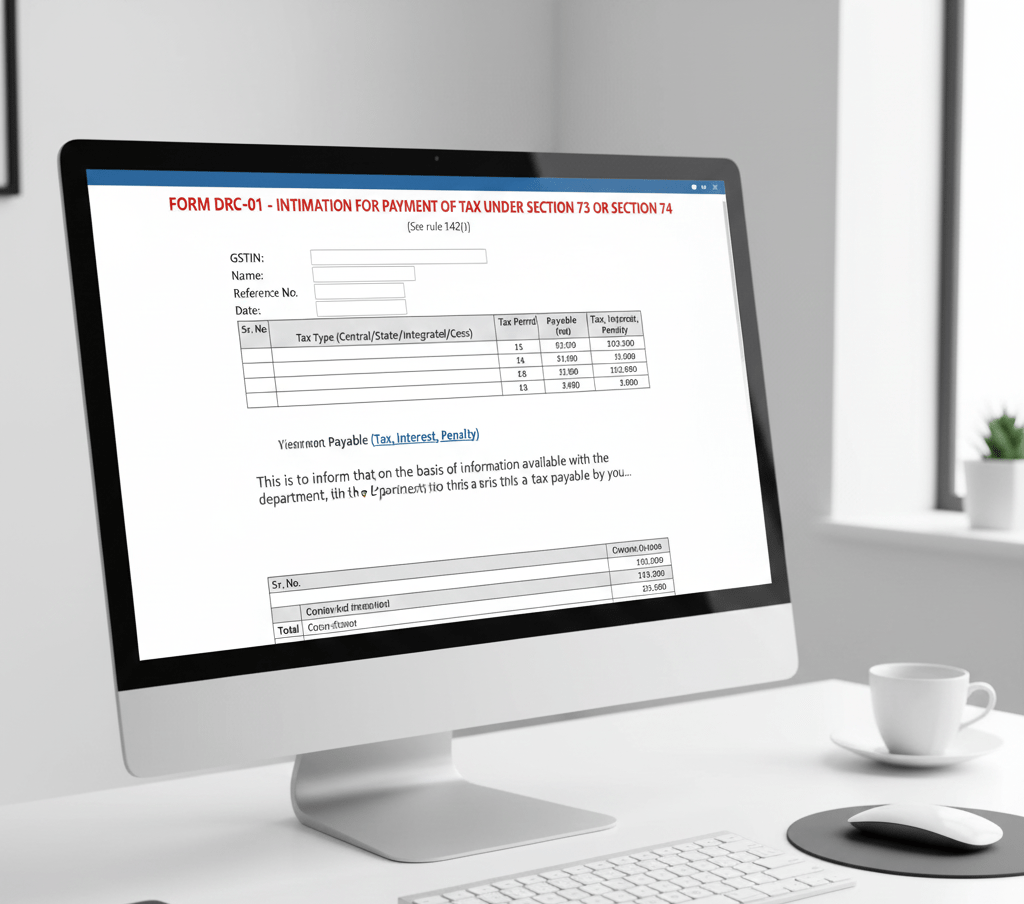

The GST portal provides tools to help identify and rectify these discrepancies. The primary mechanism for reconciliation is the Form DRC-01C, which is a system-generated intimation for differences in outward tax liability between GSTR-1 and GSTR-3B.

Here’s how to approach the rectification process, incorporating the expected latest rules for 2025:

Step 1: Identify the Mismatch

- Review DRC-01C: If you receive a DRC-01C intimation, it means the system has identified a significant difference. Access the intimation on the GST portal under “Services > User Services > View Additional Notices/Orders > DRC-01C Outward tax liability mismatch”.

- Manual Reconciliation: Even without a DRC-01C, it’s prudent to perform regular manual reconciliation.

- Compare Taxable Value of Outward Supplies: Extract the consolidated outward taxable value from your GSTR-1 for a specific period and compare it with the outward taxable value declared in Table 3.1(a) of your GSTR-3B for the same period.

- Compare Tax Paid: Verify that the tax paid as per GSTR-3B aligns with the tax liability declared in GSTR-1.

- Invoice-Level Scrutiny: For significant differences, delve into invoice-level comparison between your sales register, GSTR-1 data, and GSTR-3B summary.

Step 2: Determine the Cause of the Mismatch

Once you’ve identified the discrepancy, pinpoint the exact reason using the common causes listed above. This is the most crucial step. For example:

- Is an invoice missing from GSTR-1?

- Was a credit note incorrectly applied in GSTR-3B but not reflected in GSTR-1?

- Was a transaction reported in a different tax period in one return compared to the other?

Step 3: Rectify the Differences

The method of rectification depends on where the error lies and the nature of the mismatch.

Scenario A: Error in GSTR-1 (Outward Supplies Over-declared in GSTR-1 compared to GSTR-3B)

If your GSTR-1 shows higher outward supplies than GSTR-3B (meaning you’ve reported more sales in GSTR-1 but paid less tax in GSTR-3B), you will need to:

- Issue Credit Notes: If the over-declaration in GSTR-1 was due to actual sales returns, price reductions, or clerical errors that reduced the value of supplies, issue a credit note to the recipient.

- Amend GSTR-1:

- For previous periods: If the GSTR-1 for the period in question has already been filed, you cannot directly amend it. You must report the adjustment in a subsequent GSTR-1 filing in the “Amendments to outward supplies” (Table 9A, 9B, 9C) sections, by issuing a credit note.

- For current period (before filing): If you catch the error before filing GSTR-1, simply correct the invoice details.

- Note: The recipient’s GSTR-2A/2B will also be updated once you file the amendment, allowing them to adjust their ITC.

Scenario B: Error in GSTR-3B (Outward Supplies Under-declared in GSTR-3B compared to GSTR-1)

If your GSTR-1 shows lower outward supplies than GSTR-3B (meaning you’ve reported fewer sales in GSTR-1 but potentially paid more tax in GSTR-3B, or there’s an RCM mismatch affecting overall liability), or if you under-declared outward supplies in GSTR-3B compared to what you correctly reported in GSTR-1:

- Pay Additional Tax Liability: If you under-declared outward supplies in GSTR-3B, you must pay the differential tax liability along with interest.

- This can be done by adjusting your next month’s GSTR-3B filing (in Table 3.1, declaring the correct aggregate taxable value) and ensuring you have sufficient balance in your electronic cash/credit ledger.

- Alternatively, you can pay the tax using Form DRC-03 (Voluntary Payment) for the specific period where the under-declaration occurred. This is often preferred for immediate rectification and to avoid interest accrual.

- No direct amendment for GSTR-3B: GSTR-3B cannot be amended directly. Any adjustments or rectifications for previous periods must be made in the GSTR-3B of the current or subsequent tax period. Ensure you correctly reflect the aggregate values.

Addressing DRC-01C Intimations:

If you receive a DRC-01C intimation, you must respond within the stipulated timeframe (usually 7 days).

- Accept the Difference: If you agree with the mismatch and it means you have under-declared tax in GSTR-3B, pay the differential tax through DRC-03 and provide the ARN of the DRC-03 payment as your response to the DRC-01C.

- Provide Clarification: If you believe the mismatch is due to specific reasons (e.g., timing difference, B2C vs B2B misclassification, exempt supplies), you need to provide a detailed explanation. This is done by submitting Part B of DRC-01C, where you can provide reasons and upload supporting documents. You might explain that certain supplies were exempt, or that a credit note was issued, leading to the apparent discrepancy.

Important Considerations for 2025:

- Enhanced Data Analytics: Expect the GST system to become even more sophisticated in identifying mismatches. Regular, real-time reconciliation will be key.

- Focus on ITC Validation: The government’s push for 100% invoice matching for ITC claims means that your GSTR-1 accuracy directly impacts your recipients’ ability to claim ITC. Mismatches in your GSTR-1 can cause issues for your customers, potentially harming business relationships.

- Streamlined DRC-01C Process: While the core process remains, expect minor procedural updates to the DRC-01C response mechanism for efficiency.

- AIS and TIS Integration: The Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) will continue to play a crucial role. Ensure consistency between your GST filings and the data reflected in your AIS/TIS.

Prevention is Better Than Cure: Best Practices

To minimize mismatches and ensure smooth GST compliance:

- Automate Reconciliation: Utilize accounting software or GST reconciliation tools that can automatically compare GSTR-1 and GSTR-3B data.

- Daily/Weekly Sales Data Review: Regularly review your sales data before preparing GSTR-1 to catch errors early.

- Match GSTR-1 and Sales Register: Ensure that your GSTR-1 data perfectly matches your internal sales register/accounting records.

- Clear Policies for Debit/Credit Notes: Establish clear procedures for issuing and recording debit and credit notes.

- Educate Staff: Ensure that all staff involved in invoicing and GST compliance are well-trained on the latest rules and accurate data entry.

- Timely Filing: File your GSTR-1 and GSTR-3B returns on time to avoid late fees and give yourself ample opportunity for reconciliation.

- Review GSTR-2B: While not directly for outward supplies, regularly reviewing your GSTR-2B helps ensure your suppliers are filing correctly, reinforcing overall compliance ecosystem.

Conclusion

Maintaining accuracy between GSTR-1 and GSTR-3B is not just about avoiding penalties; it’s fundamental to sound financial management and healthy business relationships within the GST ecosystem. By understanding the causes of mismatches, diligently following the rectification steps, and implementing robust internal controls, you can effectively manage your GST compliance and navigate the evolving regulatory landscape of 2025 with confidence.

Legal Section References (Footnotes)

- [1] Section 37 of the CGST Act, 2017: Deals with the furnishing of details of outward supplies (GSTR-1).

- [2] Section 39 of the CGST Act, 2017: Deals with the furnishing of returns (GSTR-3B).

- [3] Rule 59 of the CGST Rules, 2017: Specifies the manner of furnishing details of outward supplies.

- [4] Rule 61 of the CGST Rules, 2017: Specifies the manner of furnishing the return in Form GSTR-3B.

- [5] Rule 88C of the CGST Rules, 2017: Deals with the manner of dealing with difference in tax liability on outward supplies in Form GSTR-1 and Form GSTR-3B, including the issuance of Form DRC-01C.

- [6] Section 50 of the CGST Act, 2017: Pertains to interest on delayed payment of tax.

- [7] Section 122 of the CGST Act, 2017: Deals with general penalties for certain offences.

- [8] Section 34 of the CGST Act, 2017: Deals with credit and debit notes.

- [9] Section 16(2)(aa) of the CGST Act, 2017 (as amended): Mandates that Input Tax Credit (ITC) can only be availed by a registered person if the details of the invoice or debit note have been furnished by the supplier in their GSTR-1 and such details are communicated to the recipient in Form GSTR-2B.

Stay tuned on: www.taxbabuji.com